Strengthening Indonesia’s branchless banking agent network: Challenges and lessons from evidence

Baca blog ini dalam Bahasa Indonesia.

Since the launch of branchless banking agents (agen Laku Pandai) in 2014 with a mission to accelerate financial inclusion among Indonesia’s largely unbanked population, this channel has been used to deliver basic banking services to clients in remote areas and to provide government-to-people (G2P) transfers. Branchless banking agents are deemed to be a more cost-effective way to deliver banking services to rural areas compared to providing an ATM or building a local branch.

Despite the promising opportunities of this channel, there remain numerous challenges to promoting banking services to the unbanked population. To achieve Indonesia’s financial inclusion goals, it is imperative to gather evidence on how to improve the effectiveness of branchless banking agent networks and enhance agents' performance.

To contribute to the important work of digital financial services (DFS) stakeholders in Indonesia, the Inclusive Financial Innovation Initiative (IFII) hosted a learning collaborative webinar, “Banking the unbanked: The effects of agents’ financial incentives and transparency in increasing the take-up and usage of financial products.” This webinar featured a presentation from Grace Retnowati and Raunak Kapoor from MicroSave Consulting Indonesia (MSC) on Indonesia’s agent network landscape, and IFII invited researchers Gianmarco León-Ciliotta (Pompeu Fabra University) and Firman Witoelar (Australian National University) shared learnings from a randomized evaluation conducted with IFII invited researcher Erika Deserranno (Northwestern University), which tested the impact of changing the level and transparency of agents’ financial incentives on the take-up of branchless banking products. This webinar also provided a forum for DFS stakeholders to discuss ideas or pressing issues in advancing financial inclusion in Indonesia.

Despite significant progress, numerous challenges limit the impact of Indonesia’s agent network

Since first introduced in Indonesia, the number of agents has been increasing rapidly, surpassing the stagnant growth of ATM and bank branch office expansion. In 2018, there were more than one million branchless banking agents providing basic banking services such as account opening, cash-in-cash-out (CICO), money transfers, bill payments/top-ups, and G2P disbursement. On top of branchless banking agents, there were also more than 300,000 electronic money agents in 2018 serving CICO, money transfer, and bill payments/top-ups. In 2019, fintech companies (including e-commerce, ride-hailing, and other fintech) reported 6.2 million agents serving cash-in, money transfer, bill payments/top-ups, digital loans, and other digital financial services.

Raunak argued these numbers are sufficient to serve Indonesia’s population. However, the unequal distribution of agents across the country means that a large number of clients in remote areas remain underserved. He outlined another fundamental problem: the economic viability of branchless banking agent networks. The lack of consumer demand for agent services, combined with insufficient service fees from the consumer, becomes a barrier to gain revenue to sustain the networks. In order to make the network work more effectively, Raunak proposed that we need to drive more people to use the services.

Incentives might be one way to increase agents’ performance, but we need to ensure that they lead to more take-up of financial services

In the second presentation, delivered by Firman Witoelar and Gianmarco León-Ciliotta, the researchers highlighted the urgency to produce evidence on how to improve agents' performance to attract more clients. They suggest that agents’ efforts to convert people to adopt the services might be hampered by potential clients’ lack of awareness and knowledge of branchless banking products. Low trust in the products, agents, and banks may be another constraint, making potential clients rely on observable cues to help them decide whether to adopt a new financial product.

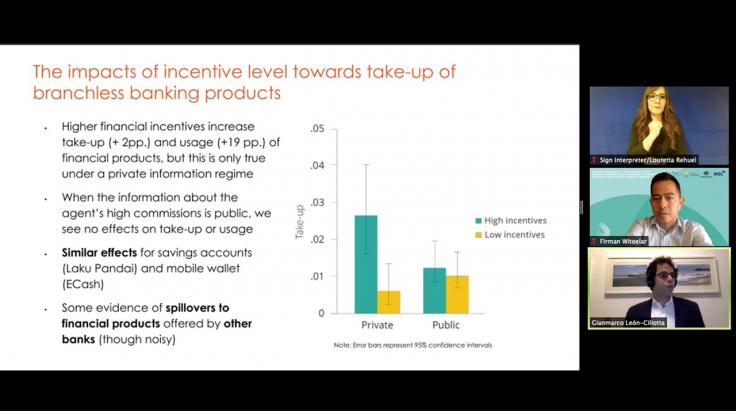

The researchers tried to answer this critical policy question through conducting a randomized evaluation measuring the impact of providing much larger financial incentives to agents and adjusting the level of transparency around incentives information for the public on the take-up and usage of branchless banking products.

The evaluation results showed that higher financial incentives could be used to boost branchless banking agents’ efforts in finding new clients more proactively, therefore increasing take-up of the financial products they are promoting. However, in a context with low levels of information and trust in financial institutions, we need to be careful about the transparency of agents' incentives.

When information about the incentives is public or known by potential clients, higher incentives (and the subsequent higher agent effort) did not translate to higher take-up or usage of financial products compared to the lower incentive amount. Researchers believe this lack of impact occurs because learning about agents’ high level of incentives to promote a product affects potential clients’ perceptions of the reliability and trust of the product, the agent, and the bank, therefore reducing their demand.

Potential ideas to improve agent network expansion as a tool for financial inclusion

Higher financial incentives for agents could be part of a strategy to increase financial penetration in rural areas; however, ensuring financial sustainability and improving clients’ trust are key. During the interactive discussion, the speakers highlighted several recommendations to improve service quality and maximize the agent network's impact.

Speakers from MSC and J-PAL SEA’s IFII agreed that as providers face profitability challenges to manage agent networks, it might be beneficial to explore how to decrease providers’ operational costs of managing agents. MSC provided several alternatives that the Government of Indonesia could consider, such as allowing agents to work for various banks in rural areas, allowing a third-party agent network manager, evaluating the incentive and fee schemes based on agents’ appetite for operations, and ameliorating the G2P model through incentive schemes for providers to expand their service and deliver better quality.

Gianmarco specifically highlighted recommendations to increase clients’ trust towards branchless banking channels. Banks might introduce agent customer ratings, as seen on e-commerce or ride-hailing platforms, to provide more reliable and crowdsourced information to help clients to increase their trust in agents and the services they provide.

It is also important to recruit agents who are known, trusted in the community, and able to promote branchless banking services' reliability. Banks also need to invest in financial products that are easier to understand and use. Grace added that financial products have to be developed to cater to rural and low-income clients' needs to ensure adoption.

Another promising avenue, Gianmarco mentioned, is through increasing agent competition at the local level. He believes that this competition will improve agents’ efforts and improve the information and choices on the clients’ side, hence enhancing their trust in the channel.

DFS innovation might improve the efficiency and effectiveness of agent operations

Grace mentioned that technology could be used to improve customer onboarding processes. For instance, a better e-KYC (Know Your Customer) infrastructure can shorten and improve the process of new account opening, whereas fintech utilizes mobile-technology to reach users, especially in rural areas. Moreover, Gianmarco pointed out that while developing user-centered products is necessary, we need to build agents' capabilities to deliver the information about the products and build people’s abilities to use DFS.

Improvement in government regulation is also needed to maximize the impact of agent networks

In order to maximize agents’ roles in advancing financial inclusion, the speakers recommended the government improve regulations related to the agent network. Firman highlighted the importance of improving e-KYC regulation. Gianmarco added that the government needs to strengthen consumer protection regulations so that it may increase clients’ trust and improve community financial literacy by introducing relevant branchless banking products.

Promoting well-designed financial products to serve rural and low-income clients may result in increased adoption and improved financial literacy in the community. MSC recommended the government open up regulations for fintech to recruit individual agents to enable them reach more clients, especially in rural areas.

This article is based on the webinar “Banking the unbanked: The effects of agents’ financial incentives and transparency in increasing the take-up and usage of financial products” on February 3, 2021, featuring IFII invited researchers Firman Witoelar (ANU) and Gianmarco León-Ciliotta (UPF, Barcelona GSE, IPEG), and Grace Retnowati (Country Director, MSC Indonesia) and Raunak Kapoor (Senior Manager, Country Program Development, MSC Indonesia).

To learn more, read the content of the presentations and CICO Economics in Indonesia report by MicroSave Consulting Indonesia.

Related Content

Tantangan dan pembelajaran untuk memperkuat jaringan agen perbankan laku pandai di Indonesia

Banking The Unbanked: The Effects Of Agents’ Financial Incentives And Transparency in Increasing The Take-up and Usage of Financial Products

Join J-PAL Southeast Asia’s Inclusive Financial Innovation Initiative for a learning collaborative webinar to share valuable findings from a randomized evaluation conducted by IFII invited researchers on increasing the take-up and usage of branchless banking products. This webinar will feature a presentation from MicroSave Consulting Indonesia about branchless banking agent networks.

To further support the important work of digital financial service (DFS) stakeholders in Indonesia, J-PAL Southeast Asia’s Inclusive Financial Innovation Initiative (IFII) is hosting a learning collaborative webinar to share valuable findings from a randomized evaluation conducted by IFII invited researchers on increasing the take-up and usage of branchless banking products. This webinar will also feature a presentation from MicroSave Consulting Indonesia about branchless banking agent networks.

The randomized evaluation was conducted to measure the impact of implementing different levels of incentives for bank agents, as well as the transparency of communicating these incentives, on the take-up of branchless banking products. During the webinar, speakers will provide an overview of Indonesia’s bank agent network and discuss evidence-based recommendations to promote branchless banking agent networks. The webinar will be a learning collaborative forum to bring together actors working in DFS and other relevant areas to identify useful recommendations in promoting financial inclusion in Indonesia. Register to attend the webinar >>

Agenda and Speakers

Opening Remarks

Lina Marliani

Executive Director, J-PAL SEA/ LPEM FEB UI

MicroSave Consulting: the Agent Landscape in Indonesia

Grace Retnowati

Country Director, MicroSave Consulting Indonesia

Raunak Kapoor

Senior Manager, Country Program Development, MicroSave Consulting Indonesia

Banking the unbanked: The effects of agents’ financial incentives and transparency in increasing the take-up and usage of financial products

Gianmarco León-Cilliotta

Pompeu Fabra University (UPF), Barcelona GSE, IPEG, IFII Invited Researcher

Firman Witoelar

Australian National University, IFII Invited Researcher

Q&A