The Impact of Secondary Education on Economic Decision-Making in Malawi

- Students

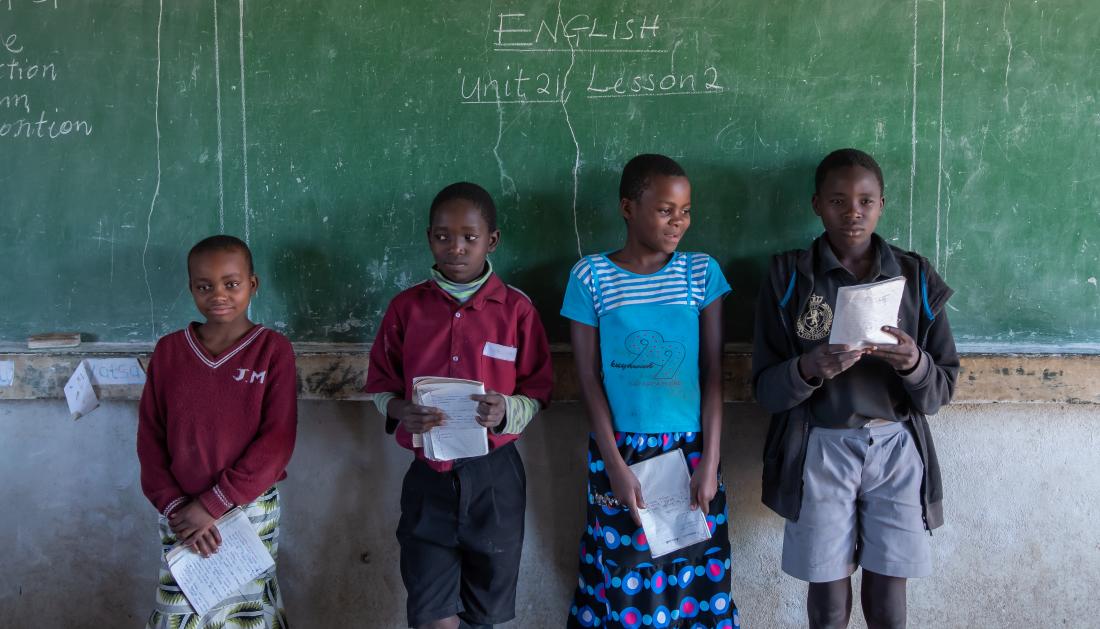

- Women and girls

- Enrollment and attendance

- Student learning

- Women’s/girls’ decision-making

- Savings/deposits

- School-based inputs

Individuals often make errors in judgment and decision-making, which can lead to costly economic and welfare losses. Schooling has been shown to positively influence a wide range of outcomes, but its influence on general decision-making abilities across different environments, including financial, has been relatively underexplored. To fill this gap, researchers evaluated whether randomly providing financial support for secondary education could improve economic decision-making in addition to educational outcomes for secondary school students in Malawi. Results show that the intervention improved educational outcomes and economic decision-making, especially among 9th grade students.

Policy issue

It has long been understood that people often make choices that are not in their best interests. This dilemma is particularly acute in financial decision-making, where poor decision-making can lead to significant impacts on the welfare of individuals and social systems at large. In response, research has explored how to alter judgments so that people choose options that are most beneficial to them. Notably, this research has historically focused on improving people’s decision-making in specific contexts, and not necessarily on how to improve their decisions generally.

In an effort to explore how decision-making can be improved more generally, researchers in this study turned toward education. Research in schools has shown that education can be a powerful tool for providing students with valuable skills and outcomes that are relevant outside of the classroom and within other contexts, such as those related to health, income, and crime. Yet, there has been little research to explore how education improves people’s decision-making generally. To answer this question, researchers ran a randomized evaluation in Malawi to see if offering financial support for education can improve students’ financial decision-making abilities.

The evaluation also adds to the body of research assessing the value of secondary schooling. Moreover, the United Nations’ Sustainable Development Goals expanded on the Millennium Development Goals to include a focus on life-long learning.1 However, evidence on the impacts of secondary and tertiary education is still extremely rare. This research contributes to these questions by assessing the impact of secondary schooling education on economic decision-making quality.

Context of the evaluation

The Malawian education system consists of eight years of free primary education and four years of tuition-paying secondary education (grades 9 to 12). To complete secondary education, students must pass two national exams: the Junior Certificate Examination (JCE), held at the end of 10th grade, and the Malawi School Certificate Examination held at the end of 12th grade.

Across Malawi, students face barriers to education, especially girls and those living in rural areas — such as the participants in this study. In 2015-2016, only 21.4 percent of women ages 20-24 years old had some secondary education, and only 9.8 percent completed secondary school education.2 Additionally, in 2016, 40 percent of students lacked access to schooling, versus 26 percent in urban regions.3 Other data reveals that specific grades may be more disadvantaged than others. National enrollment data suggests that 9th graders may be particularly vulnerable to dropping out of school because of the financial barrier present in the transition from free primary school to tuition-based secondary school. Students in this study paid US$60 to $100 in tuition annually.

In 2016, the World Bank reported Malawi remained one of the least developed countries with a GDP per capita of US$306.4 While the economy remains somewhat stagnant, women appear to have a growing influence in the economy. From 2010 to 2016, the percentage of women who had sole control of their earnings or shared responsibility of their earnings with their husbands rose from 58 to 76 percent. For both men and women, those living in rural areas, those with less education, and those with lower levels of wealth had less control over family spending. 1

Details of the intervention

In 2012, researchers evaluated the impact of offering financial support for education on educational outcomes and economic decision-making. Researchers randomly provided financial support at the classroom level to 3,997 female students in grades 9 to 11 at 33 public schools.

The intervention consisted of paying school tuition and fees for one year and providing a monthly cash stipend: MWK 3,500 (about US$21 in 2012) for each of the three semesters of the school year plus a monthly cash stipend of MWK 300-500 (about US$2-3 in 2012). The total amount of support equaled approximately US$70 per student, contingent on the student remaining in school until the end of the program.

To assess the impact of the intervention, the researchers examined a range of educational and decision-making outcomes, including:

Educational outcomes: In 2013, a year after the initial intervention, researchers implemented a short-term follow-up survey to understand if the financial assistance successfully increased educational outcomes. The researchers looked at several different indicators, including rates of absence, dropout, completion of the JCE, and passing of JCE. Four years after the original intervention, the researchers measured total years of schooling and administered an additional math test to gauge long-term educational outcomes.

Economic decision-making outcomes: In 2016—four years after providing the financial support—the researchers conducted a long-term follow-up survey to measure the program’s impact on economic decision-making through a series of exercises that required them to choose how to allocate money. Using a risk tolerance exercise, researchers evaluated whether participants chose to receive smaller, guaranteed amounts of payment or rather opt for larger amounts with less certainty of payout. In a time-preference exercise, researchers also asked participants to allocate money over time—over 31 days and 395 days—to see if they would delay receiving payments in order to receive a higher future amount. Across both exercises, the more economically rational decisions individuals make, the better researchers considered their economic decision-making abilities.

Results and policy lessons

Students assigned to receive the financial intervention demonstrated improvements across a range of educational outcomes—they missed fewer days of school and they also took and passed the JCE more. They also performed better on the financial management task, indicating that education can lead to better economic decision-making.

Educational outcomes: Overall, students who received access to the program demonstrated improved educational outcomes. Across grade levels, students in the financial assistance group attended an average of 1.6 more days of school (a 40 percent increase), were 5.5 percentage points (7 percent) more likely to enroll in the JCE, and 8.6 percentage points (14 percent) more likely to pass the JCE, relative to students in the comparison group. However, researchers did not observe any changes in dropout rates or total years of schooling as a result of the intervention.

Importantly, the effects of the intervention appear to be mainly driven by changes among 9th graders. Ninth graders in the financial assistance group attended school 1.5 more days (42 percent) and were 8.3 percentage points (61 percent) less likely to drop out of school, 12.3 percentage points (20 percent) more likely to enroll in the JCE, and 14.1 percentage points (28 percent) more likely to pass the JCE, relative to students who did not receive access to the financial intervention.

Economic decision-making outcomes: Looking at student results across a range of economic decision-making measures, decision-making improved for those in the intervention group. For 9th graders’ decision-making, they make more economically rational decisions than those in the comparison group by 3.3 percentage points (4 percent) in the risk tolerance exercise and 3.1 percentage points (3.7 percent) in the time-preference exercise. However, for 10th graders, the researchers did not find any effects of the intervention on general decision-making abilities as they did not in educational outcomes.

By checking whether the improvement of decision-making is driven by the effects of the intervention on economic preferences, cognitive abilities, and personality, the researchers find that they explain only partially the effects on general decision-making abilities, by about one-third.

This study provides evidence of the impacts of secondary school education on economic decision-making quality, which could impact the welfare of individuals and society in the long run.

UN. 2015. “Transforming our world: The 2030 agenda for sustainable development.” New York, NY: United Nations.

“Malawi Demographic and Health Survey 2015-16.” 2017. National Statistical Office (NSO) [Malawi] and ICF.

“Child Poverty in Malawi Policy Brief.” 2018. UNICEF (December).

"Macro Poverty Outlook: Country-by-Country Analysis and Projections for the Developing World." 2020. World Bank.