Microcredit: Impacts and promising innovations

Evaluations of innovations to microcredit products, such as targeting high-potential entrepreneurs or providing flexible repayment options, led to higher business and household outcomes and show promise for financial service providers looking to reduce poverty through credit. Moreover, adjusting the mode of loan disbursement can crucially increase women’s control of capital.

Summary

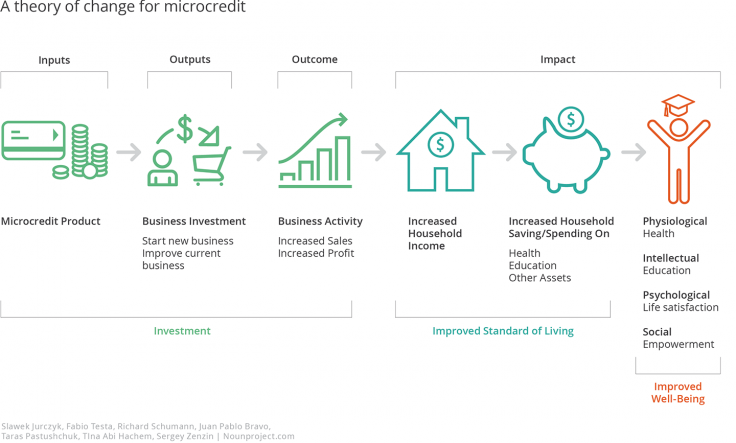

Many policymakers are interested in entrepreneurship as a potential pathway out of poverty, and several studies show that small-scale entrepreneurs have access to high-return investments [1] [2] [3]. Yet, low-income households have historically had limited access to financial services such as credit, savings, and insurance products that could lead to increased investments [4].1 Microcredit was designed to overcome credit market failures and help low-income borrowers take advantage of investment opportunities. It expanded access to credit around the world, typically in the form of small business loans with relatively high interest rates and immediate, biweekly loan repayments. In 2018, around 140 million people around the world were active borrowers from a microcredit institution, a 43 percent increase from 98 million in 2009 [4].

A review of seven randomized evaluations in low- and middle-income countries, which studied microcredit expansions between 2003 and 2009, found that the traditional microcredit model did not facilitate high-return investments among the poor or lead to transformative results for the average borrower. Demand for traditional microcredit products—which have high repayment frequencies, charge high interest rates, hold groups of borrowers jointly liable for each other’s individual loans, and typically target women—was more modest for many borrowers than many of its advocates had claimed. Investments often rose but did not lead to increased average enterprise profits in most cases, though researchers have drawn differing conclusions on whether these effects are detectable when pooling across studies [13] [20] [38]. Additionally, investment in children’s schooling did not rise, and there were no increases in average household incomes. The traditional microcredit model also did not lead to increases in women’s empowerment on average despite the vast majority of microcredit products being targeted toward women. However, microcredit did not lead to widespread harmful effects as critics had feared, and it even gave households more freedom in their financial decision-making [5] [6] [7] [8] [9] [10] [11] [12] [19].

Donors with the goal of supporting poverty reduction by financing or subsidizing microcredit lending should understand the limitations of the traditional microcredit model. However, they should also recognize how various product design innovations can improve upon it. First, a meta-analysis of randomized evaluations found that for businesses with no experience, the impacts of microfinance were negligible. In contrast, the impacts were potentially large for entrepreneurs with prior experience owning a business, suggesting that more targeted and larger loans can raise the overall impact of credit [13] [20]. One longer-run study suggests these differences may actually widen over time [21]. Second, traditional microcredit products demanding immediate, inflexible repayment may perpetuate liquidity constraints on borrowers. Four randomized evaluations have shown that credit products with more flexible repayment options led to increased business profits or household income [22] [23] [24] [25]. Third, changing the mode of loan disbursement by providing women with private accounts or digitizing payments can enable female entrepreneurs to invest more in their own businesses, whereas they may have previously felt pressure to share financial resources [3] [26]. In addition to these product innovations, two studies found that microcredit had impacts that extended beyond its clients and influenced the wages, household earnings, and social networks of local nonborrowers as well [27] [28].

Supporting evidence

Demand for traditional microcredit products was modest when offered to a general population. In four studies where microcredit institutions offered microloans to a general population, take-up ranged from 13 to 31 percent [6] [7] [10] [11]. This was much lower than what the partner microcredit institutions had originally forecasted. Demand was higher among borrowers who had already expressed interest in or applied for a loan, ranging from 40 to 100 percent [8] [9] [19]. These results suggest that traditional microcredit may be perceived as a useful product by some, but not all, potential borrowers [5][12].

Randomized evaluations of the traditional microcredit model found limited returns to the average borrower while also suggesting that expanded access to credit led to high returns for some entrepreneurs. Despite access to credit resulting in higher rates of business ownership, greater business revenues, more business investments, and increased inventory and assets in five out of the seven countries, most borrowers did not see these effects translate to higher business profits [6] [7] [9] [10] [19].

Microcredit only led to higher average business profits in Morocco, where profits increased by 22 percent on average. Even within this context, these profit increases were driven by larger businesses and borrowers that had previously farmed and owned livestock [6]. In India, three years after microcredit was introduced, profit increases were concentrated among the most profitable businesses that had existed before the expanded access to microcredit [10].

| Outcome | Bosnia and Herzegovina | Ethiopia | India | Mexico | Mongolia | Morocco | Philippines |

|---|---|---|---|---|---|---|---|

| Business revenue | — | — | — | ↑ | — | ↑ | — |

| Business inventory/ assets | ↑ | no data | ↑ | no data | ↑ | ↑ | — |

| Business investment/ costs | — | — | ↑ | ↑ | no data | ↑ | ↓ |

| Business profit | — | — | — | — | — | ↑ | — |

| Household income | — | — | — | — | — | — | — |

| Household spending/ consumption | — | ↓ | — | ↓ | ↑ | — | — |

| Social well-being | — | — | — | ↑ | — | — | ↓ |

Note: Green (red) arrows represent statistically significant positive (negative) differences in outcomes between the treatment and comparison groups at the 90 percent confidence level or higher, dashes represent no statistically significant difference.

More recent research, including long-term follow-ups and meta-analyses of earlier randomized evaluations, suggests that targeting certain groups like high-potential entrepreneurs may increase the impact of microcredit products [13] [20] [21]. Returning to India, researchers found that six years after receiving access to microcredit, households who were already managing an enterprise at baseline were generating more than double the revenue and reported 35 percent more business assets than their similarly experienced peers who did not receive access to microcredit. By contrast, households with no prior experience running a business did not grow their business or increase firm revenues [21]. A meta-analysis of seven randomized evaluations similarly found that the impact of microcredit was negligible for households with no business experience before the introduction of microcredit, while there was potential for large increases in household income among those with prior business experience [13].

Microcredit institutions have several possible avenues to target high-potential entrepreneurs, although further research is needed to measure the effectiveness of these avenues and what others may exist. Differential impacts between high-potential entrepreneurs and those with less experience mean that it may be worthwhile to allocate more financial capital to a smaller set of productive businesses, which can increase employment and wages as they grow. However, some borrowers may not use microcredit for their business but for other important purposes such as consumption and risk mitigation. For example, some borrowers reported using loans to smooth consumption (15 percent in India) or buy goods (8.5 percent in Bosnia and Herzegovina and 15 percent in India) [9] [10]. Policymakers can continue to support those who may not be considered high-potential entrepreneurs by increasing access to other low-cost financial services like savings accounts or insurance products.

The important question of how these entrepreneurs can be identified, aside from deploying a wide and expensive network of banking agents, also arises. A key ingredient to the feasibility of the traditional microcredit model is that it does not require costly information generation, making this question challenging to resolve. Many microcredit studies have also struggled to capture exactly how borrowers use their loans, further illustrating the difficulties that lenders face in gathering information about their clients.

One randomized evaluation in Egypt studied an alternative way of providing lenders insight into their clients by surveying firm owners about their personal initiative, preference for flexible schedules, and other questions designed to identify potential for business success. Those who were predicted to perform well indeed earned 55 percent higher profits and increased monthly wages paid to employees by EGP 2,400 (about USD$160) per month, or 122 percent, relative to the comparison group [29].

Graduating borrowers to asset-based microcredit, or credit products tied to a specific asset, may also hold potential as a mechanism to target high-potential entrepreneurs, as clients of such products would need to have successfully repaid previous loans to be eligible for asset-based microcredit. In Pakistan, credit-based access to a productive asset worth up to USD$1,900 raised business assets by USD$401 (a 40 percent increase) and monthly household income by USD$31 (a 9 percent increase) [30]. Outside the context of microfinance, community knowledge and mobile phone data have also demonstrated promise as tools to identify high-potential entrepreneurs [15] [31]. However, more research is needed before firm conclusions can be drawn around which targeting mechanisms should be recommended to policymakers.

Modifications to the traditional microcredit model such as grace periods and flexible repayment options can improve business outcomes and consumption. Traditional microcredit models are characterized by high repayment frequency requirements, with repayment often occurring on a biweekly or even weekly basis almost immediately after loan disbursement, framed by providers as a way to promote fiscal discipline among borrowers [32]. Yet, putting such stringent requirements on entrepreneurs and other small-scale business owners may fail to consider irregular cash flows, such as those common in seasonal industries like agriculture and sales of other perishable goods [14] [22] [33] [34]. Product and market innovations can make it easier for banks to lend at lower costs. Meanwhile, including grace periods or having more flexible microcredit products can enable firm owners to withstand negative shocks and accumulate the capital required for costly and riskier higher-return investments, thereby relaxing constraints to business growth.

Indeed, an early randomized evaluation in India found that providing a two-month grace period enabled clients to accumulate a larger lump sum of capital and thus make larger business investments. The grace period increased weekly profits by INR 640 (41 percent) and monthly household income by 20 percent relative to the comparison group, but clients’ likelihood of default also rose by up to 9 percentage points (213 percent more than the comparison group) [25]. An eleven-year follow-up to this study found that illiterate household enterprise owners increased their income by 27 percent compared to their illiterate counterparts who did not receive the product [37].

Four recent randomized evaluations also found that flexible repayment contracts led to increases in business profits but suggest that flexibility does not necessarily raise default rates [22] [23] [24] [39]. In India, a flexible microcredit product that allowed for borrowing and repayment at any time increased profits by up to INR 125 (15 percent), and borrowers were no more likely to default after a short-term period of four months [22]. Also in India, an option for borrowers to defer payments at a time of their choosing both increased monthly profits and sales and raised the likelihood of repaying the full loan early by 10 percentage points (a 33 percent increase) after three years. Borrowers previously exposed to volatile sales were more likely to opt for a deferral [23]. In Bangladesh, an option to delay two repayments increased annual household income by US$1,309 (17 percent) and reduced the likelihood of default by 1.7 percentage points (35 percent). Clients who chose to delay repayment were more willing to engage in business risks such as investing in tools and machines, suggesting that flexibility may have induced more entrepreneurial risk taking [24].

However, one study found that providing payment deferral options for first-time borrowers instead of repeat borrowers increased default rates by 3–4 percentage points (5 percent) while leading to no changes in profits [39]. Taken together with the other studies, these findings suggest the need for greater understanding around which types of borrowers may suffer from increased risk without a corresponding increase in return from repayment flexibility. Moreover, these findings may align with those of the previous section if first-time borrowers are less likely to use microcredit for business purposes than high-potential entrepreneurs.

| Country | Innovation | Effect on firm profit | Effect on household income | Effect on likelihood of default | |

|---|---|---|---|---|---|

| Aragón, Karaivanov, and Krishnaswamy (2020) | India | Repay whenever | ↑ 15 percent (INR 125), daily | N/A | None (only short-term impacts studied) |

| Barboni and Agarwal (2023) | India | Repayment deferral option | ↑ INR 5,241, monthly (compared to the comparison group losing INR 5,170) | N/A | None |

| Battaglia et al. (2021) | Bangladesh | Repayment deferral option | ↑ 27 percent (USD $97), monthly | ↑ 17 percent (USD $1,309), annually | ↓ 1.7 percentage points (35 percent) |

| Brune, Giné, and Karlan (2022) | Colombia | Repayment deferral option | Insignificant effects | N/A | ↑ 3–4 percentage points (5 percent) |

| Field et al. (2013) | India | Grace period | ↑ 41 percent (INR 641), weekly | ↑ 19.5 percent, monthly | ↑ 6–9 percentage points (213-372 percent) |

The traditional microcredit model did not increase income, women’s empowerment, or investment in children’s schooling. Microfinance institutions (MFIs) have typically prioritized lending to women given the barriers that they have historically faced in accessing credit and formal banking services in low- and middle-income countries [35]. Yet, two evaluations found that credit did not lead to increased investment or improved business outcomes for women [2] [36]. Moreover, in three of the four studies that evaluated women’s empowerment, microcredit access had no effect [6] [7] [10] [11]. In Mexico, where Compartamos Banco emphasized empowerment as part of its product, women did enjoy a small increase in decision-making power [7]. In addition, the six studies that measured children’s schooling also found no effect [6] [7] [9] [10][11][19]. By contrast, one study found that a more flexible microcredit contract can lead to long-run increases in educational attainment for children of borrowing households [37].

Two recent studies suggest that intrahousehold dynamics affect the use of microfinance. Changing the mode of loan disbursement to give women more control over the loan proceeds can help ensure that the product fit the needs of their enterprises [3] [26]. Uncovering how microcredit can ease financial constraints of female business owners remains an important area of study. A reanalysis of three randomized evaluations of microcredit and cash grants suggest that household dynamics may be a barrier to growth for women-owned enterprises. Specifically, women-owned businesses that are the sole enterprise of the household see higher returns to credit than those who do share households with men-owned businesses and may thus have to compete for household financial resources [3].

A recent study that evaluated the impact of digital loan disbursement on female borrowers offers a potential way to prevent the misallocation of capital. Directly depositing loans into a private mobile money account increased women’s monthly enterprise profits by USD$18 (15 percent) and the value of their business capital by USD$70 (11 percent) relative to those who received cash. An examination of the characteristics of the entrepreneurs who benefited the most from the digital loan disbursement highlighted that receiving the loan on a mobile money account alleviated pressure to share the loan with family and increased women’s control over the loan. [26]. These studies provide suggestive evidence that products that tighten women’s control of their capital can enable higher returns in their enterprises.

Microcredit may also have broader impacts in local economies, affecting even those who do not borrow from MFIs. In principle, it is possible that microcredit access could increase the wages and employment of nonborrowers if borrowers use loans to consume local goods and services, to purchase more business assets, or to hire new workers. However, testing the effects of microcredit on an economy-wide scale is challenging to do with randomized evaluations. One quasi-experimental study examined the effects of an unanticipated, state-level regulation in Andhra Pradesh, India that wiped out USD$1 billion across the country and revealed that losing access to microcredit lowered investment and overall expenditures in districts that experienced a greater decline. As a result, daily wages fell by around 4 percent, contributing to a decline in weekly household earnings of INR 86 (a 10 percent decrease) [27].

Although the results above suggest that the arrival of microcredit created positive spillovers to some types of local economic activity in India, negative spillovers may also exist if access to microcredit reduced the availability of informal credit. One randomized evaluation in Hyderabad, India and one quasi-experimental study in Karnataka, India found that the introduction of MFIs in participating communities led to reductions in social network links, including those of households unlikely to borrow from MFIs. Consistent with the idea that social network relationships often serve as informal sources of credit and insurance in local communities, borrowing activity fell most sharply for households unlikely to borrow from MFIs [28]. All together, these results suggest that policymakers may need to look beyond just borrowing households when assessing the impact of microcredit.

Abdul Latif Jameel Poverty Action Lab (J-PAL). 2023. "Microcredit: impacts and promising innovations." J-PAL Policy Insights. Last modified May 2023.